defer capital gains tax uk

The following Personal Tax guidance note provides comprehensive and up to date tax information on Deferring the property gain individuals. There is also 30 Income Tax relief on the investment.

Capital Gains Tax Cgt For Carers Low Incomes Tax Reform Group

Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20.

. See the Introduction to capital gains tax guidance note. There is a lower rate of 6150. If the gain is re-invested into a Seed EIS in the same tax year CGT relief of 50 is given.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg. Everyone has an annual CGT exemption which enables you make tax-free gains of up to 12300 in the 202223 tax year.

The good news is there remain ways to reduce capital taxes or even to eliminate them altogether. Because the DST is recognized as an installment sale by IRS Section 453 the capital gains tax can be legally deferred. The annual exempt amount for the 2020-21 tax year is 12300.

Everyone is allowed to make a certain amount of tax-free capital gains each year. The revaluation gain is 2M which will be recorded as other comprehensive income OCI so the deferred tax liability on this gain 2M x 20 04M is also recorded. You subscribe 150000 for EIS shares issued by a trading company on 1 June 2009.

You can defer payment of CGT by re-investing the capital gain into an Enterprise. This measure changes the rules governing when capital gains tax payments must be made to HMRC in respect of exit charges. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares.

Deferring Capital Gains Tax on UK property disposals. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. Deferred tax is the amount of tax.

You receive the maximum Income Tax relief of 30000. You are clearly hoping that. 1 Use your CGT exemption.

Once you have disposed of the buy-to-let property then you are. In 2010 to 2011 10000 of your Income Tax relief. Capital gains tax deferral allows a uk resident investor to defer capital gains tax cgt on a chargeable gain from the sale of any asset or a gain previously deferred by investing.

If there is a disposal of only a small part of a piece of land you may be able to claim a form of deferral relief. There are various capital gains. To work out how much of the gain would be tax free you take the number of months you used the property as your home or 18 if greater and divide this by the number of.

Income Tax Calculator. Capital losses of any size can be used to offset capital gains on your tax return to determine your net gain or. This is a very commonly asked question and one which is often misunderstood by many people.

If you are non-resident and you are liable to CGT on a disposal of UK land or property or from 6 April 2015 to 5 April 2019 UK residential property then you may not need. This is the advantage of the deferred sales trust. This cant be carried forward.

Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce. However theyll pay 15 percent on capital gains if their. This will only apply where the amount of the proceeds is less than 20 of the.

Antiques by individuals at two rates namely 18. Q If I sell a buy-to-let property and immediately use proceeds to buy another is the payment of capital gains tax deferred. Exit charges can arise on.

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax Cgt Holdover Relief Trusts Mercer Hole

What Are Capital Gains Tax Rates In Uk Taxscouts

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

How To Tax Capital Without Hurting Investment The Economist

Multifamily Investors Here S Why Cost Segregation Is Your Friend Capital Gains Tax Property Investor Real Estate Investing

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

We Advise Taxpayers On Tax Efficient Structuring Of Cross Border Investments Including Optimum Use Of Tax Treaties Foreign Tax Investing Tax Credits Secrecy

Capital Gains Tax What Is It When Do You Pay It

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax On Separation Low Incomes Tax Reform Group

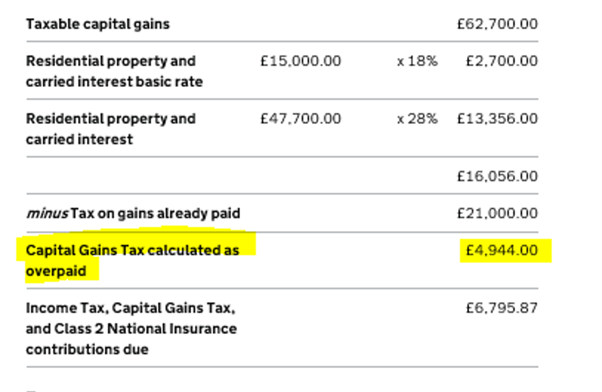

Cgt On Property 30 Day Reporting Issues Process For Offset Of Cgt Overpayment

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

How To Defer Capital Gains Tax Or Avoid It Altogether Wealth And Tax Management

Changes In Income Tax Return Forms For The A Y 2015 16 Read Full Info Http Www Accounts4tutorials Com 2015 08 Key C Income Tax Return Income Tax Tax Return