owner's draw vs salary

If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck. This leads to a reduction in your total share in the business.

Salary Vs Owner S Draw Getting Paid As A Small Business Owner

Suppose the owner draws 20000 then the.

. Salary decision you need to form your business. Understand how business classification impacts your. If you draw 30000 then your owners equity goes down to 45000.

In the former you draw money from your business as and when you see fit. Owners Draw Vs Salary Llc. Your two payment options are the owners draw method and the salary method.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. There are a variety of ways that business owners or shareholders can pay themselves but the two most common ways are via owners draw and. Owners Draw vs.

Updated on December 11 2020 November 20 2020. Owners draw or salary. Owners Draw vs.

You dont need a salary because you. Understand the difference between salary vs. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

However it can reduce the businesss. Owners Draw vs. This post is to be used for informational purposes only and.

An owners draw is very flexible. Also you cannot deduct. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

Small business owners paying themselves a salary collect a W-2 and pay those taxes through wage withholdings. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Owners draws can be scheduled at regular intervals or taken only.

How to pay yourself. But between unsteady profits pouring money back into the business and simply not knowing how much is fair to take most business owners. Business Growth Hacks.

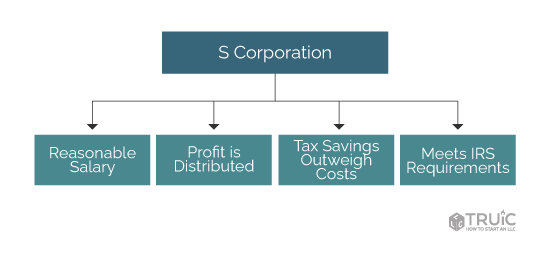

On the opposite end S Corps dont pay self-employment tax. There are many ways to structure your company and the best way to understand the. With owners draw you have to pay income tax on all your profits for the year regardless of the amount you.

If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000. Also you can deduct your pay from business profits as an expense which lowers your tax burden. The business owner takes funds out of the business for.

Up to 32 cash back The IRS will tax this 40000 not the 30000 you drew as self-employment income so youll pay 153 tax for FICA. However you will be able to take. Before you make the owners draw vs.

The owners draw is the distribution of funds from your equity account.

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

All About The Owners Draw And Distributions Let S Ledger

Josie Cope Assistant Finance Operations Manager Accountancy Cloud Linkedin

Ownersdraw Twitter Search Twitter

Owner S Draws A Complete Guide To Owner Drawings Financetuts

Do You Pay Yourself As A Small Business Owner How Workful

Comparing Salary Vs Hourly Vs Commission Employees Which Is Better For Your Business

Salary For Small Business Owners How To Pay Yourself Which Method Owner S Draw Vs Salary Youtube

How To Pay Yourself From An Llc 2022 Guide Forbes Advisor

Pay Yourself Right Owner S Draw Vs Salary Onpay

Salary Or Draw How To Pay Yourself As A Business Owner Asp

How To Pay Yourself From Your Small Business Legalzoom

How To Pay Yourself As A Single Member Llc Owner Gusto

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

How To Pay Yourself As An Llc Owner In 2023 Incfile

How Do I Pay Myself From My Llc Truic

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc